Beyond the credits

Phase-out of federal incentives returns sustainability to its foundation in cost savings

Sustainability efforts have evolved over the past several years. Many institutional owners and investment managers are now seeking “decarbonization,” or the elimination of CO2 and other greenhouse gas emissions from their properties’ operations.

Clean energy sources, electrification, and carbon capture are strategies these companies are using to achieve this goal. Risk management remains top of mind for these organizations, as their investors are still pushing hard to mitigate climate change impacts on their real estate investments.

Phase-out of federal tax credits

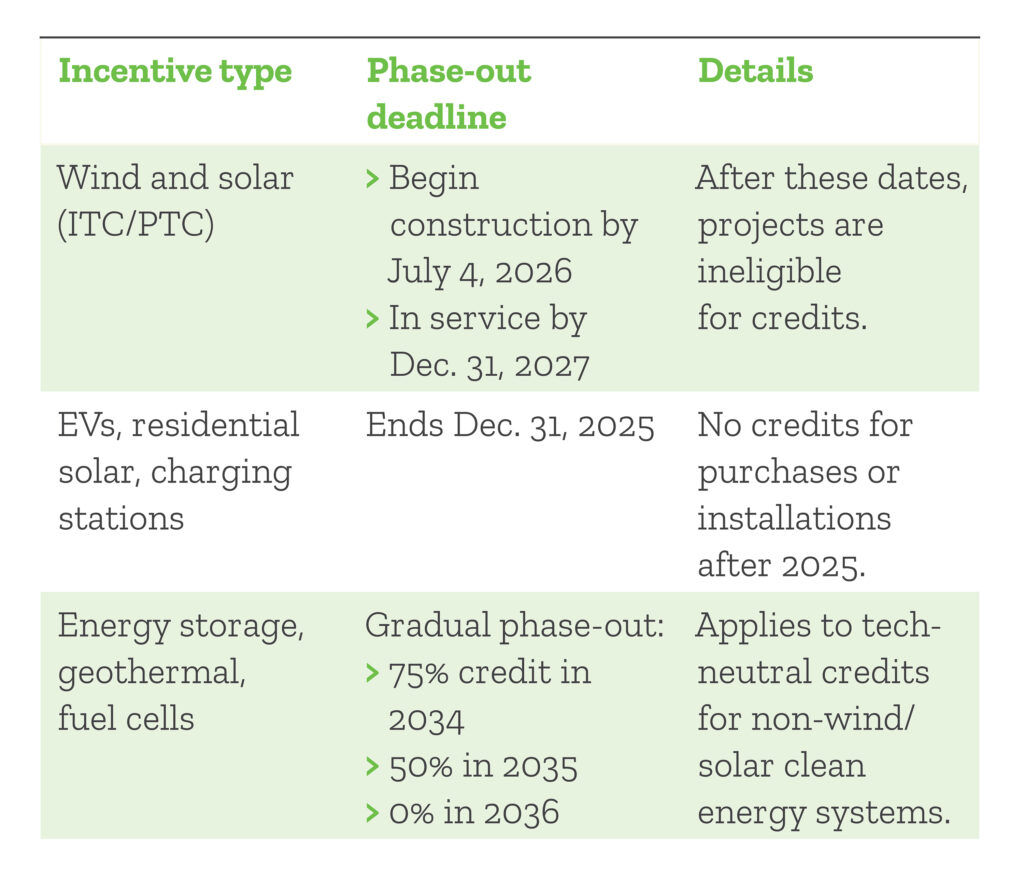

In the U.S., there are headwinds against decarbonization. The One Big Beautiful Bill Act (OBBBA) phases out the federal incentives for clean energy projects established in the Inflation Reduction Act (IRA). What’s being phased out? Both investment tax credits (ITCs) and production tax credits (PTCs) for wind and solar projects; credits for energy storage, fuel cells, and geothermal projects; and credits for EVs, residential solar projects, and charging stations.

Here’s a table summarizing the phase-outs and their timing.

These phase-outs may happen even sooner than what’s written in the bill. Several factors are accelerating the timeline:

- Executive Order enforcement. A July 7, 2025, Executive Order directs the U.S. Department of the Treasury to issue stricter guidance on what qualifies as “beginning of construction” for wind and solar projects. This could make it harder for developers to meet eligibility deadlines for credits.

- Foreign Entity of Concern (FEOC) rules. Projects with ties to China, Russia, Iran, or North Korea are disqualified from receiving credits. This includes supply chains. These rules are causing uncertainty and compliance challenges for developers.

- Compressed timelines. Developers now face a 12-month window to begin construction or risk losing eligibility. The complexity of permitting, financing, and procurement means many projects in development may fail to meet these deadlines.

- Shift in policy priorities. The bill reflects a broader policy shift away from federal support for clean energy and toward fossil fuels. More rollbacks and stricter enforcement are likely to occur. Clean energy projects may stop altogether.

What does this mean for property managers?

The trend away from federal incentives for decarbonization has largely refocused sustainability efforts on their cost-saving benefits. Reducing operating expenses has always been one of the key motivations for implementing green initiatives in income-producing real estate. Those benefits never waned, especially in energy efficiency and, in some markets, water efficiency.

Prompted by local building codes and greater knowledge among architects and construction professionals, properties are built with more sustainable features and equipment. Management teams are more knowledgeable about sustainable operations, and they’re well-positioned to help identify the energy and water efficiency projects that will reduce costs.

The proliferation of technology for buildings—proptech—has made even greater efficiency gains possible, and not just in energy and water. Sensor technology and AI-enabled solutions have automated the monitoring and reduction of resources, leading to cost savings.

Ebony Landon, CPM®

Ebony Landon, CPM®, senior vice president, property operations, JBG SMITH, explains that proptech can enable management companies to transform even routine building functions, like waste management, into strategic, data-driven advantages.

“We first introduced Enevo smart sensors in our commercial portfolio nearly four years ago,” says Landon, “then expanded the program to our residential communities two years later. Installed in trash and recycling containers, these sensors provide real-time data on fill levels, allowing property teams to optimize pickup schedules and reduce unnecessary hauls.”

Working in partnership with haulers, the data has allowed them to identify service gaps and unlock cost savings where appropriate, says Landon. The program advances the company’s sustainability goals by reducing truck traffic, lowering emissions, and fostering cleaner, more efficient communities.

So what should property managers do to serve their owners in this environment?

- Reduce operating costs through energy and water efficiency. Seek out cost savings through the reduction of energy, water, and waste. These opportunities will improve property NOI and may align with owner sustainability objectives. Proactively familiarize yourself with your clients’ objectives and targets by investigating their sustainability reports and other information on their websites. Then, identify projects that match their goals.

- Research incentives. Research the local and state incentives, like utility rebates, available for the property. IREM is collaborating with IncentiFind to help you conduct this research. IncentiFind provides comprehensive, property-specific incentives reports, called Verify Reports. Get a 30% discount on Verify Reports for your properties by going to the IREM sustainability page. Through Apply Services, IncentiFind can manage the incentives process to ensure no money is left on the table.

- Explore proptech solutions. Do your research, take meetings with solution providers, and find the best tools for your portfolio. Conduct pilots and phased rollouts to assess the performance of the solutions and whether they deliver on promised returns.

- Optimize utility rates. Lock in utility rates with energy procurement contracts. Participate in demand response programs, where your properties reduce or shift their electricity usage during periods of high demand in exchange for financial incentives or lower rates. To make sure you’re getting the lowest rate possible, contact your utility representative or consider a utility bill audit to identify billing errors, overcharges, and incorrect rates.

- Be ready to support clean energy investments. Even without federal incentives, some owners may be willing to invest in clean energy to future-proof their assets and advance their sustainability goals. Become familiar with the clean energy landscape and ways to move these projects forward in the current political environment. For example, nothing in the OBBBA prevents an owner from using alternative financing programs, such as Property Assessed Clean Energy (PACE) lending, which allows property owners to finance upgrades through a voluntary property tax assessment.

Sustainability’s foundation has always been focused on higher NOI through operational cost savings. Those benefits are still accessible, even without federal tax credits for the installation of solar or EV charging. Property managers are well-positioned to help identify those cost-saving efficiency projects, potentially advancing owner sustainability goals.

Similar Posts

Sustainability

Beyond the credits

Phase-out of federal incentives returns sustainability to its foundation in...